Studenti.it and Intesa Sanpaolo together for financial education

Online now YounGOALS, a project aimed at students that brings together the digital brand leader in the education segment with Italy’s leading banking group

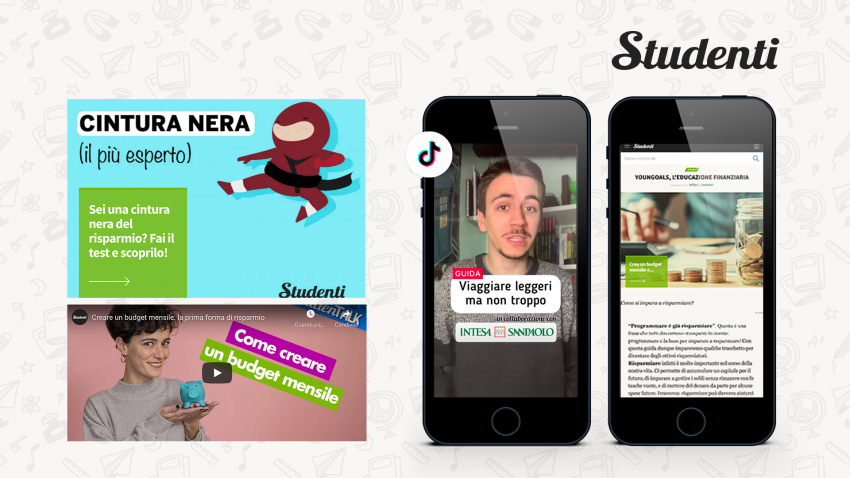

Studenti.it, the Mondadori Group brand that is a point of reference in the education segment, is launching, in collaboration with Intesa Sanpaolo, Italy’s leading banking group for households and businesses and one of Europe’s biggest banks, YounGOALS, a financial education programme aimed at young people, who are invited to test their knowledge in the field of business and economics.

This initiative will enable Intesa Sanpaolo to use its skills to bring young boys and girls closer to concepts such as saving and investment and make them more aware of the importance of their present and future financial decisions while taking advantage of the collaboration of Studenti.it to get in touch with Gen Zers and understand better their needs and interests.

The project – which has been developed with the support of Mediamond, the advertising sales company owned by Mediaset e and the Mondadori Group – is organised in different stages and demonstrates the strengths and ability of Studenti.it to interact with an increasingly broad community. In fact, for many years the brand has reached an audience of young people with innovative language and content, which now numbers over 3.7 million unique users per month (Source: Audiweb, average January-July 2021) and almost 1 million fans on social meda (Source: Shareablee + TikTok and Pinterest Insight, October 2021), of which 400,000 on TikTok alone.

This success is due to a unique and continuously updated editorial offer, elaborated with the contribution of a team of young creators working to engage students in a variety of learning experiences with lessons, audio and video clips, study guides, advice, notes and much more.

A THEMATIC ROADMAP IN A NUMBER OF STAGES – The project developed in partnership with Intesa Sanpaolo has the specific objective of helping young people to reinforce their knowledge about finance and the economy, making it easier to understand apparently complex issues and concepts.

“Learning how to manage savings is something that can be taught and learned from a very young age. And it can expand our opportunities, make us more independent and contribute to our future serenity,” explained Andrea Lecce, director of Sales & Marketing for Private clients and Retail Companies at Intesa Sanpaolo. “This is why financial education, provided in a concrete but fun way, as in the collaboration with Studenti.it, has always been a central focus of Intesa Sanpaolo. In recent years, a million young people, of which around 300,000 under 18s, have chosen to open an account with us, completely free of charges, so that they can become familiar with basic financial services. Around 30% of mortgages are for young people, with favourable condition to help them realise the dream of owning a home. And we are committed to offering them the best financial solutions, supporting them in their studies and, in the future, the most innovative tools to face the challenges of the world of work.”

“The financial education programme developed together with Intesa Sanpaolo allows us to further consolidate the role of Studenti.it in the training of young people,” said Pamela Carati, Brand Manager Entertainment & Science at Mondadori Media. “In fact, this collaboration is a demonstration of how much our brand has been able, in recent years, to become a point of reference across the entire period of the life of younger generations. Every day we strive to provide answers to their needs with innovative educational content, in dynamic language and formats and increasingly on social media. These are the strong points that enable us to identify and intercept the needs of Gen Z and maintain an open dialogue and fruitful exchange with all of them. A winning formula that, also thanks to the efforts of young creators, is rewarding us across all platforms, in particular on TikTok, where the brand has obtained truly extraordinary results and where we have shown, with all of the content marked as #imparacontiktok, that the platform is both light but also substantial, and has led to some 400,000 followers in just one year,” concluded Carati.

The campaign got started with an online survey that involved over 56,000 users between the ages of 16 and 25, and made it possible to identify the issues of most interest and put together the second stage of the initiative: a range of content on 6 different macro-themes, available with weekly updates on all of the channels where the Studenti.it offer is available: web articles, podcasts, videos on YouTube and contributions on TikTok, Instagram and Facebook, as well as a final quiz. Space for methods for the proper management of savings, tools for effective planning of expenditure, ways to make online purchases and those to protect against scams, as well as forms of insurance and the most common types of loans for foreign studies and training, and the search for the first sources of income, the sharing economy and sustainability.

A PROFILE OF YOUNG ITALIANS But how much do young Italians really know about finance and economics? From the survey conducted by Studenti.it, in collaboration with Intesa Sanpaolo, in the first phase of the entire campaign it emerged that young people start to talk about money and savings in the family and, in fact, this is the primary source of information for 36% of the young people who took part in the survey.

For 26% the first ideas about finance come from school, while another 26% gets their information from digital platforms. Among the economic and financial topics they would like to know more about, almost 2/3 of the participants put savings plans top of the list in order to one day be able to make important purchases or pay for their studies (32%). As regards channels to find work and benefit from a source of income, 48% of the interviewees, are in no doubt: going to university and obtaining a qualification is a way of standing out on the market.

3 in 4 students have already started to save, but only 31% of them methodically plan their monthly spending. To manage their resources, 24% of the sample make use of pre-paid cards, 22% mainly use a bank current account and another 12% a post office current account. Finally, most of the participants believe that travelling far away from their families is the first real test of their ability to manage a budget: so it is not a coincidence that for 46% their main objective is to plan their spending in the best way so as not to run out of money, while for 21% the priority is to insure against theft, accidents or other unexpected events.

These results clearly show the need for a targeted and innovative educational process to which this project provides a response in a learning context that is increasingly social and digital.

All of the details of the YounGOALS project- which are continuously updated – are available here.